If you have a mortgage, or a car loan, or credit card, you probably pay attention to interest rates. And these days that means you probably keep a pretty close eye on the Federal Reserve.

Several times a year the Fed’s Board of Governors meets to set short term rates, and as a result, long-term rates – such as mortgages – and bond rates and equity markets take their cue from that.

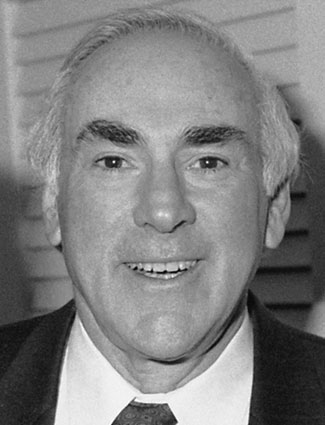

For five and a half years, from 1996 to 2002, economist Laurence Meyer was a Fed Governor. He was among those experts who met a few times a year to keep the economy on track.

He described that experience in his 2004 book A Term At The Fed.

Now if you’re like me and never got past Econ 101 in school, there’s nothing in this interview that you need to be an economist to understand. Rather, it’s a personal exploration of how one man navigated the gulf between theory and practice. And often laughed at himself.

So here now, from 2004, Laurence Meyer.

Laurence Meyer is 80 now. He has been involved in various roles since his Fed term ended.